News Releases

LAKEWOOD, CO, Aug. 2, 2016 /CNW/ - Energy Fuels Inc. (NYSE MKT: UUUU; TSX: EFR) ("Energy Fuels" or the "Company"), a leading producer of uranium in the United States, is pleased to announce that it has received an independent technical report (the "Technical Report") containing a current mineral resource estimate for its 100%-owned Alta Mesa ISR Project located in Brooks and Jim Hogg Counties, Texas, including the Alta Mesa and Mesteña Grande deposits and exploration targets ("Alta Mesa"), in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). According to the Technical Report, Alta Mesa holds a total of 1.6 million tons of measured and indicated mineral resources with an average grade of 0.111% U3O8 containing 3.6 million pounds of uranium, along with 7.0 million tons of inferred mineral resources with an average grade of 0.121% U3O8 containing 16.8 million pounds of uranium. In addition, the technical report identifies certain exploration targets at Alta Mesa that includes 2.6 million tons of mineralized material with an average grade of 0.08% - 0.123% U3O8 containing 4.1 to 6.6 million pounds of uranium. These mineral resources further add to Energy Fuels' industry-leading, U.S.-based uranium resource portfolio.

Please note that the tonnages, grades and contained pounds of uranium for the exploration targets should not be construed to reflect a calculated mineral resource estimate (measured, indicated or inferred). The potential quantities and grades for exploration targets are conceptual in nature, and there has not been sufficient work completed to date to define an NI 43-101 compliant resource. Furthermore, it is uncertain if additional exploration will result in any of the exploration targets being delineated as a mineral resource estimate in the future.

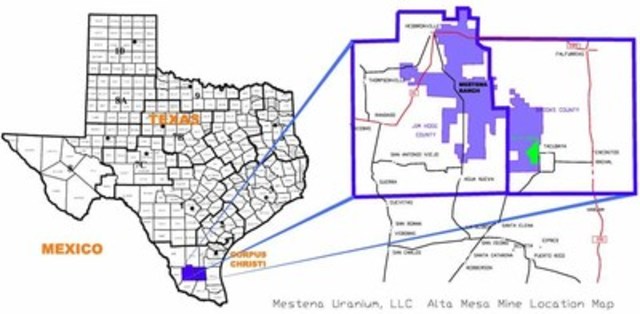

As previously announced, Energy Fuels acquired Alta Mesa through its June 17, 2016 acquisition of Mesteña Uranium, LLC. In addition to the uranium resources identified above, Alta Mesa also includes a fully-licensed and constructed ISR processing facility which is currently on standby status, pending improvements in uranium market conditions. As a result of the acquisition of Alta Mesa, Energy Fuels now has three fully-licensed and operational uranium production centers – two that utilize in situ recovery ("ISR") and one that utilizes conventional technologies – with a combined licensed and operational capacity of 11.5 million pounds of uranium per annum. As described in the report, the Alta Mesa project area encompasses 200,076-acres of contiguous property including (i) the current mining lease of 4,575 acres which holds the production facilities and existing wellfields, and (ii) a lease option area of 195,501 acres.

Stephen P. Antony, President and CEO of Energy Fuels stated: "Alta Mesa is the flagship asset Energy Fuels obtained through our June 2016 acquisition of Mesteña Uranium, LLC. However, since Mesteña was privately-held, no resource estimate was previously prepared for Alta Mesa in compliance with NI 43-101. Therefore, we are very pleased to announce a maiden NI 43-101 compliant resource estimate for this key project. We believe we created real shareholder value through our $11 million, all-stock acquisition of Mesteña Uranium, LLC and its Alta Mesa Project. Not only does Alta Mesa contain the resources described in the NI 43-101 technical report, but it also has a fully-licensed and constructed processing plant built in 2005 that can produce finished uranium product available for sale to global nuclear utilities. Based on operating results from 2005 – 2013, when Alta Mesa was previously in production, we also believe that Alta Mesa could have some of the lowest 'all-in' costs of production within our portfolio, providing us with significant production scalability that we can bring online sooner and at lower uranium prices. We are also particularly proud of the fact that we have built the largest uranium resource portfolio in the U.S., among current producers and near-producers, and Alta Mesa's maiden resource estimate further cements our dominant position in this category."

The author of the Technical Report is Douglas L. Beahm, P.E., P.G., of BRS Consulting, who is a qualified person and independent of Energy Fuels for purposes of NI 43-101. The effective date of the Technical Report and the mineral resource estimate is July 19, 2016. A copy of the technical report is being filed under the Company's SEDAR profile at www.sedar.com.

Key assumptions and parameters utilized in determining the mineral resource estimate contained in the Technical Report include the following: (i) a minimum grade cut-off of 0.02% U3O8 and a minimum grade x thickness (GT) of 0.30, which is considered reasonable for economic extraction utilizing ISR methods; (ii) a bulk density factor of 17 ft3/ton was utilized which is considered conservative for ISR extraction; (iii) drill data for 10,744 drill holes was analyzed, including about 3,000 drill holes within existing wellfields; (iv) prompt-fission-neutron (PFN) log data was available for 92.8% of the 10,744 drill holes, which is considered reasonably equivalent to chemical assays; (v) where possible, width and GT parameters were determined from specific drill data, and where this was not possible, trend width was determined from data available from two existing wellfields; and (vi) the contained pounds of uranium were calculated from the GT value applied to the respective area of mineralization with the application of the appropriate bulk density.

Because the project has operating permits in place and there is an existing, adjacent ISR production facility, the risks associated with the mineral resource estimate contained in the Technical Report are considered low. There are no known legal, political or other risks that could materially affect the potential development of the mineral resources at Alta Mesa, other than the normal risks associated with obtaining permits in the future for additional wellfield development, and with resource estimates and mining generally, as disclosed in the Company's most recent annual report on Form 10-K.

About Energy Fuels: Energy Fuels is a leading integrated US-based uranium mining company, supplying U3O8 to major nuclear utilities. Energy Fuels holds three of America's key uranium production centers, the White Mesa Mill in Utah, the Nichols Ranch Processing Facility in Wyoming, and the Alta Mesa Project in Texas. The White Mesa Mill is the only conventional uranium mill operating in the U.S. today and has a licensed capacity of over 8 million pounds of U3O8 per year. The Nichols Ranch Processing Facility is an ISR production center with a licensed capacity of 2 million pounds of U3O8 per year. Alta Mesa is an ISR production center currently on standby. Energy Fuels also has the largest NI 43-101 compliant uranium resource portfolio in the U.S. among producers, and uranium mining projects located in a number of Western U.S. states, including one producing ISR project, mines on standby, and mineral properties in various stages of permitting and development. The Company's common shares are listed on the NYSE MKT under the trading symbol "UUUU", and on the Toronto Stock Exchange under the trading symbol "EFR". The Company's Debentures are listed on the Toronto Stock Exchange under the trading symbol "EFR.DB."

Stephen P. Antony, P.E., President & CEO of Energy Fuels, is a Qualified Person as defined by Canadian National Instrument 43-101 and has reviewed and approved the technical disclosure contained in this news release.

Cautionary Note Regarding Forward-Looking Statements: Certain information contained in this news release, including any information relating to: the Company being a leading producer of uranium in the U.S.; the resource estimate, conclusions and assumptions contained in the NI 43-101 technical report for the Alta Mesa Project; the future exploration potential for the Alta Mesa Project; the Company's ability to restart production at the Alta Mesa Project upon sufficient improvements in uranium market conditions; the Company's claim to have created shareholder value through the acquisition of Mesteña Uranium, LLC; the Company's expectations regarding 'all-in' costs of production at Alta Mesa and any other project; production scalability at the Alta Mesa project ; the Company cementing its position as a dominant owner of uranium resources in the U.S.; the risks associated with the resource estimate; and any other statements regarding Energy Fuels' future expectations, beliefs, goals or prospects; constitute forward-looking information within the meaning of applicable securities legislation (collectively, "forward-looking statements"). All statements in this news release that are not statements of historical fact (including statements containing the words "expects", "does not expect", "plans", "anticipates", "does not anticipate", "believes", "intends", "estimates", "projects", "potential", "scheduled", "forecast", "budget" and similar expressions) should be considered forward-looking statements. All such forward-looking statements are subject to important risk factors and uncertainties, many of which are beyond Energy Fuels' ability to control or predict. A number of important factors could cause actual results or events to differ materially from those indicated or implied by such forward-looking statements, including without limitation factors relating to: the Company being a leading producer of uranium in the U.S.; the resource estimate, conclusions and assumptions contained in the NI 43-101 technical report for the Alta Mesa Project; the future exploration potential for the Alta Mesa Project; the Company's ability to restart production at the Alta Mesa Project upon sufficient improvements in uranium market conditions; the Company's claim to have created shareholder value through the acquisition of Mesteña Uranium, LLC; the Company's expectations regarding 'all-in' costs of production at Alta Mesa and any other project; production scalability at the Alta Mesa project; the Company cementing its position as a dominant owner of uranium resources in the U.S.; the risks associated with the resource estimate; and other risk factors as described in Energy Fuels' most recent annual report on Form 10-K and quarterly financial reports. Energy Fuels assumes no obligation to update the information in this communication, except as otherwise required by law. Additional information identifying risks and uncertainties is contained in Energy Fuels' filings with the various securities commissions which are available online at www.sec.gov and www.sedar.com. Forward-looking statements are provided for the purpose of providing information about the current expectations, beliefs and plans of the management of Energy Fuels relating to the future. Readers are cautioned that such statements may not be appropriate for other purposes. Readers are also cautioned not to place undue reliance on these forward-looking statements, that speak only as of the date hereof.

SOURCE Energy Fuels Inc.

Image with caption: "Energy Fuels has received a maiden NI 43-101 resource estimate for its 100%-owned Alta Mesa ISR Project. In addition to significant in-ground uranium resources, this production-ready project includes a fully-permitted and constructed ISR processing plant and access to over 200,000-acres of prospective land. (CNW Group/Energy Fuels Inc.)". Image available at: http://photos.newswire.ca/images/download/20160802_C5080_PHOTO_EN_745749.jpg